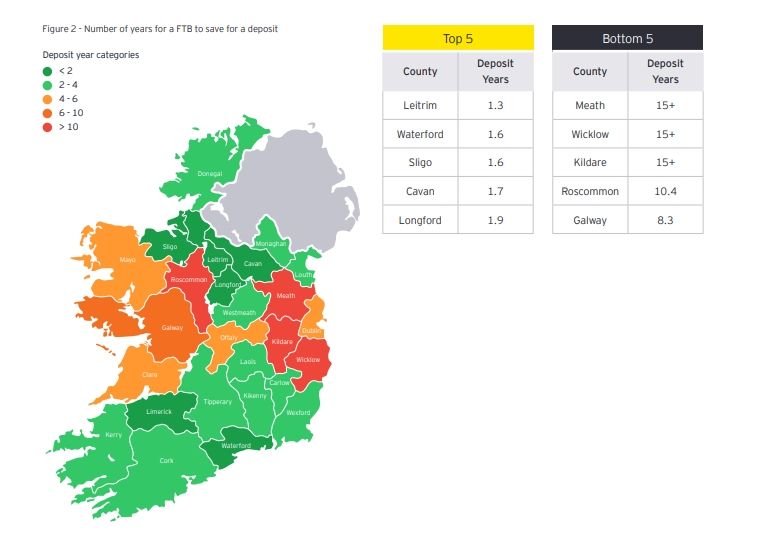

Deposits for buying a house are far more affordable in some counties in Ireland than others.

First-time buyers in Meath, Kildare and Wicklow face having to save up for more than 15 years to be able to afford a deposit on a house, according to a report published on Tuesday.

A report, titled ‘Just how affordable is housing for Ireland’s first-time buyers?’, published by EY-DKM Economic Advisory, outlines how affordable housing deposits are in all 26 counties in the Republic of Ireland.

Not surprisingly, it is the counties outside of Dublin where first-time buyers are finding it most difficult to get their feet on the property ladder.

Using a tool based on four factors – net household income, household expenditure, rental prices and house prices – the report determined that first-time buyers in Meath, Wicklow and Kildare face having to save for over 15 years for a deposit.

At the other end of the scale, it takes less than two years in Longford (1.9 years), Cavan (1.7), Sligo (1.6), Waterford (1.6) and the most affordable county to save for a deposit in Ireland, Leitrim (1.3).

After Meath, Kildare and Wicklow, meanwhile, Roscommon (10.4 years) and Galway (8.3) also featured high on the list of least affordable counties, while it was calculated that it takes 4.3 years for first-time buyers to save for a deposit in Dublin.

The report also ranked the most affordable and least affordable counties based on both the ability to pay the mortgage and the time needed to save for a deposit.

Wicklow is again considered the least affordable, followed by Kildare, Meath, Dublin and Galway, while Leitrim was the most affordable, with Longford, Sligo, Cavan and Tipperary making up the top five.

The report concluded that all of the major urban areas of Ireland are becoming increasingly unaffordable, with deposits taking many years to accumulate.

“The analysis presented here should resonate with the current Government policy of achieving more balanced regional development,” the report concludes.

“The objectives of Project 2040 include more balanced growth across the country in terms of population, homes and job creation. With one million extra people expected to be living in the country by 2040, policy makers need to carefully plan for this growth, and its consequences.

“A policy priority must be to create viable alternatives to Dublin by encouraging the creation of jobs in areas where housing is more affordable. This has to be accompanied by adequate investment in infrastructure and services in these areas to ensure sustainable growth of communities across the country.

“The upside of this policy stance should be a lower requirement for social housing, thereby generating public expenditure savings.

“These findings help identify where affordable housing is needed, but councils must consider how best to deliver this housing and how to attract private sector involvement in social housing projects, whilst also delivering best value for money.”

You can read the report in full here.

LISTEN: You Must Be Jokin’ with Aideen McQueen – Faith healers, Coolock craic and Gigging as Gaeilge