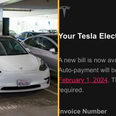

Revolut announced upcoming changes to their privacy policy this week.

The Irish Data Protection Commission (DPC) has said that it will be engaging with financial technology company Revolut as “a matter of urgency” over their new policy changes.

Revolut announced this week that it’s updating its privacy policy and cookies policy, coming into effect on 12 November this month.

In response to a query from JOE, the DPC confirmed that they’re looking at the privacy policy changes from the company.

“As part of the DPC’s supervisory role, we will be engaging with Revolut as a matter of urgency in relation to changes it has made to its privacy policy to ensure compliance with the GDPR,” the DPC said.

Revolut said on Thursday they are fully compliant with all relevant data protection regulations, including GDPR.

Speaking to JOE, a Revolut spokesperson said they had proactively informed users of the upcoming changes to allow time for users to make a decision on the data they share.

“We are proactively informing customers of changes to our privacy policy that will be introduced on 12 November, in order to allow time for users to choose how we treat and use their data,” the spokesperson said.

“Customers can stop data being used for marketing purposes using the toggle switch in the App. Data for credit purposes can easily be disabled by contacting Revolut through the App and do not impact customers’ credit scores unless they choose to apply for a credit product.

“Any data we do collect is used in order to provide a better user experience, through targeted products and pricing and the customer remains in control of their data at all times. As clearly stated in the terms and conditions Revolut will never sell customer data.”

Revolut’s new privacy policy means that users will have their data shared with social media and analytics companies for marketing purposes and also with credit bureaus, unless they actively opt-out.

Revolut doesn’t give users a way to opt-in to sharing their data for marketing purposes but instead opts users in by default and tells them that they’ll have to opt-out if they don’t like it.

Opting out of having information shared for targeted marketing purposes requires users to go to the settings button on the dashboard section of the app. They then have to enter the privacy section and toggle the opt-out.

To stop Revolut sharing your data with credit bureaus, you have to send a chat message via the app asking to opt-out of the data sharing.

The company said they did not provide a toggle button for this because it is currently provided to credit agencies once a month, but turning the toggle off within a monthly period would result in some of the data being shared.

By using the chat, it allows the support agent to record the date of the request and inform the customer of the period from which their data will no longer be shared.

LISTEN: You Must Be Jokin’ with Conor Sketches | Tiger Woods loves Ger Loughnane and cosplaying as Charles LeClerc