Share

20th June 2018

06:12pm BST

Patricia Callan of the Drinks Industry Group of Ireland (DIGI) and Director of ABFI, commented on Eurostat's figures, mentioning that tax has a huge part to play.

“Our high excise tax is an anti-competitive tax on one of Ireland’s largest employers and fastest-growing industries.

“Today’s figures show definitively that Ireland’s price levels vary significantly and that our excise rates are completely out of kilter with our European peers. This is yet another reminder that action is needed now. Ultimately, high levels of excise are a tax on businesses and a sector that contributes significantly to the Irish economy in terms of jobs, particularly in rural Ireland. It is also a penal recession-era tax on consumers which needs to be reversed.

“DIGI, through its Support Your Local campaign, is calling on the Government to take special notice of Ireland’s drinks and hospitality sector as it formulates Budget 2019 and will be seeking a reduction in our high excise tax rate to support the continued growth and development of this industry."

Patricia Callan of the Drinks Industry Group of Ireland (DIGI) and Director of ABFI, commented on Eurostat's figures, mentioning that tax has a huge part to play.

“Our high excise tax is an anti-competitive tax on one of Ireland’s largest employers and fastest-growing industries.

“Today’s figures show definitively that Ireland’s price levels vary significantly and that our excise rates are completely out of kilter with our European peers. This is yet another reminder that action is needed now. Ultimately, high levels of excise are a tax on businesses and a sector that contributes significantly to the Irish economy in terms of jobs, particularly in rural Ireland. It is also a penal recession-era tax on consumers which needs to be reversed.

“DIGI, through its Support Your Local campaign, is calling on the Government to take special notice of Ireland’s drinks and hospitality sector as it formulates Budget 2019 and will be seeking a reduction in our high excise tax rate to support the continued growth and development of this industry."

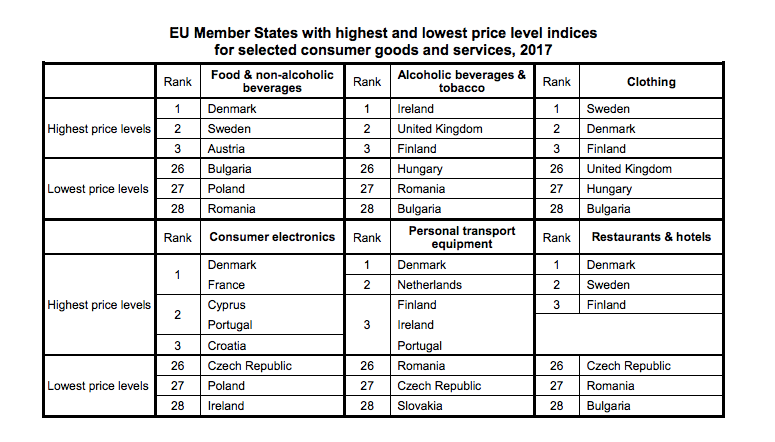

Consumer electronics, however, are at their cheapest in Ireland in comparison to Member States.

This is a group that also varied widely across the 28 countries, ranging from 86% of the average in Ireland to 110% in Denmark and France.

Clothing is another market showing a smaller price disparity among Member States, with Bulgaria (80% of the average) cheapest and Sweden (134%) most expensive.

With the noticeable exception of Denmark (144% of the average) and the Netherlands (121%), price differences among Member States were also limited for personal transport equipment, from 81% in Slovakia to 111% in Finland, Ireland and Portugal.

Consumer electronics, however, are at their cheapest in Ireland in comparison to Member States.

This is a group that also varied widely across the 28 countries, ranging from 86% of the average in Ireland to 110% in Denmark and France.

Clothing is another market showing a smaller price disparity among Member States, with Bulgaria (80% of the average) cheapest and Sweden (134%) most expensive.

With the noticeable exception of Denmark (144% of the average) and the Netherlands (121%), price differences among Member States were also limited for personal transport equipment, from 81% in Slovakia to 111% in Finland, Ireland and Portugal.Explore more on these topics: