“It is a diving issue and a lying issue, and by that, I mean people literally diving on the floor or pretending to trip over something.”

Leading insurance brokers say pubs and shops in Ireland will be forced to close if the claims and compensation culture in the country is not tackled.

Brokers at Insuremyshop.ie claim that small businesses in Ireland are crippled under the weight of insurance costs due to growing volumes of fraudulent claims all over the country.

Jonathan Hehir, Managing Director at insuremyhouse.ie, says that “a relatively small, but very active and dangerous cohort of people” who “engage in the practice of falsifying insurance claims” is having an adverse effect on the cost of insurance premiums for small businesses in Ireland.

“This has the knock-on effect of putting upward pressure on insurance premiums – be they motor or commercial – as insurers endeavour to recoup the losses made on the back of these claims pay-outs,” Hehir said.

“This, in turn, is having a devastating effect on some small Irish businesses as they can no longer afford their commercial insurance and public liability premiums.

“It’s a wicked irony that the economy might be improving but the benefits are being negated by increased litigation from ‘professional’ insurance claimants and a subsequent rise in the cost of insurance.”

Several weeks ago, representatives from the business and insurance industries went before the Oireachtas Joint Committee on Business, Enterprise and Innovation to make representations to policymakers on the cost of doing business.

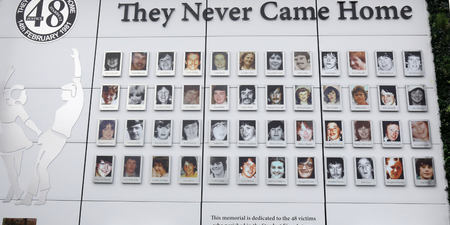

The Committee was told how businesses throughout the country are closing as a result of crippling fraudulent public liability (PL) claims and subsequent premium increases, with fraudulent claims described as a “plague” on small businesses in Ireland by Insuremyshop.ie.

“Too many commentators refer to this as a public liability insurance issue, but it’s not,” Hehir added.

“It is a diving issue and a lying issue, and by that, I mean people literally diving on the floor or pretending to trip over something, or pretending to steal items from the store in order to accuse the shop assistant/ owner of defamation when questioned.

“From what we see on the ground, a significant portion of these cases are intentionally planned by ‘legal criminals’ that have invariably benefited from similar exercises in the past. Professional criminals as the smart ones – instead of breaking the law, they see the law as stupid or ineffective, and make a living from manipulating it in their favour.”

Another major fraud issue on the rise for shop owners is staged ‘wrongful arrest’ or defamation, where fraudsters pretend to steal an item and when asked if they have paid for it, initiate proceedings to claim for defamation, through a letter from a solicitor.

These cases typically cost insurers between €5,000 and €10,000.

The CFM group, the company behind Insuremyshop.ie, intends to campaign for a register it believes will help curb the activities of ‘professional insurance claimants’ who, the company believes, are making a substantial living from falsifying multiple claims.

For more information on insurance fraud in Ireland, check out insuranceconfidential.ie.

LISTEN: You Must Be Jokin’ with Aideen McQueen – Faith healers, Coolock craic and Gigging as Gaeilge