Between the hotel breaks, spa treatments, make-up deliveries and designer dresses, today’s popular bloggers have a pretty sweet deal. Ask around however and not everyone is entirely happy about it.

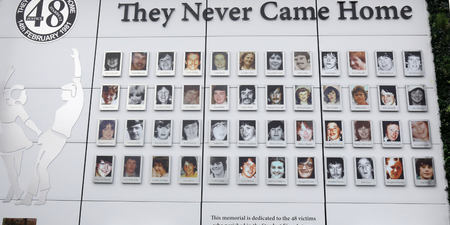

Sure, there may be more than a little jealousy at play here, but the majority of Irish people asked about their feelings towards blogger freebies believe that many of them aren’t paying their fair share of tax.

In fact, according to a Taxback.com survey of 800 adults, 70 percent of respondents believe Revenue needs to police these online professionals more heavily to ensure they are meeting their tax obligations.

A new industry

“Social media and digital marketing is a whole new, lucrative and dynamic industry.” says Christine Keily of Taxback.com.

“Like most things, it started from humble beginnings but has now become a crucial part of the marketing strategy of many of the biggest brands in the world.

“The people who first started blogging from their bedroom have realised that there is a market for this as an occupation and that they can capitalise, in some cases handsomely, on their efforts.”

However, if you’re the owner of a growing brand, you could be putting yourself in the firing line when it comes to Revenue.

“While some of the bigger names in the industry would have set themselves up as a business, we believe that there are lots of smaller blogging ‘operations,’” says Kiely.

“These people have secured a certain level of online ‘followers’ which means that brands and businesses, while not paying cash directly, may give them goods and services for free – as a thank you for promoting their offering. However, what lots of people may not realise is that in the eyes of the Revenue these freebies could be deemed as taxable.”

Monitoring

The Competition and Consumer Protection Commission has started to monitor blogger and influencer channels to check for instances of product promotion in return for payment through products or ‘non-monetary benefits’.

Continuing to promote products or services without declaring the nature of the promotion or paying tax on the income from these promotions could be viewed as tantamount to tax evasion in some cases.

The Advertising Standards Authority of Ireland is also keeping a watchful eye on developments and warns that sponsored online content “must clearly state that the material is a marketing communication”.

The issue of transparency when it comes to endorsements isn’t going away anytime soon. In fact, as the blogosphere continues to expand, income from blogging is only going to be further scrutinised by the relevant powers that be.

The advice? If you run a blog, take a good look at how Revenue could view the value of the items you receive to review.

Payment or gift?

Christine Keily comments, “Generally, when bloggers are sent gifts, they are under no actual obligation to review the items. Therefore, it is not payment, but a gift.

‘However, the long arm of the taxman can have a claim on these ‘gifts’ once the value is above a certain threshold. If the value of the gifts (material items, or services) given by a single person/company is more than €3,000 in a tax year, then there is a tax implication and you must pay any tax due.”

LISTEN: You Must Be Jokin’ with Aideen McQueen – Faith healers, Coolock craic and Gigging as Gaeilge