Share

26th March 2018

12:05pm BST

According to Angela Keegan, Managing Director of MyHome.ie, the price increases of 2017 were largely driven by strong jobs growth, rising incomes and increasing competition among buyers for the limited number of homes available.

She believes that the Help to Buy scheme and the easing of mortgage lending rules by the Central Bank of Ireland led to an undoubted increase in first time-buyer activity, as well as an increase in prices. As a result of those policy interventions, prices hit double digit growth.

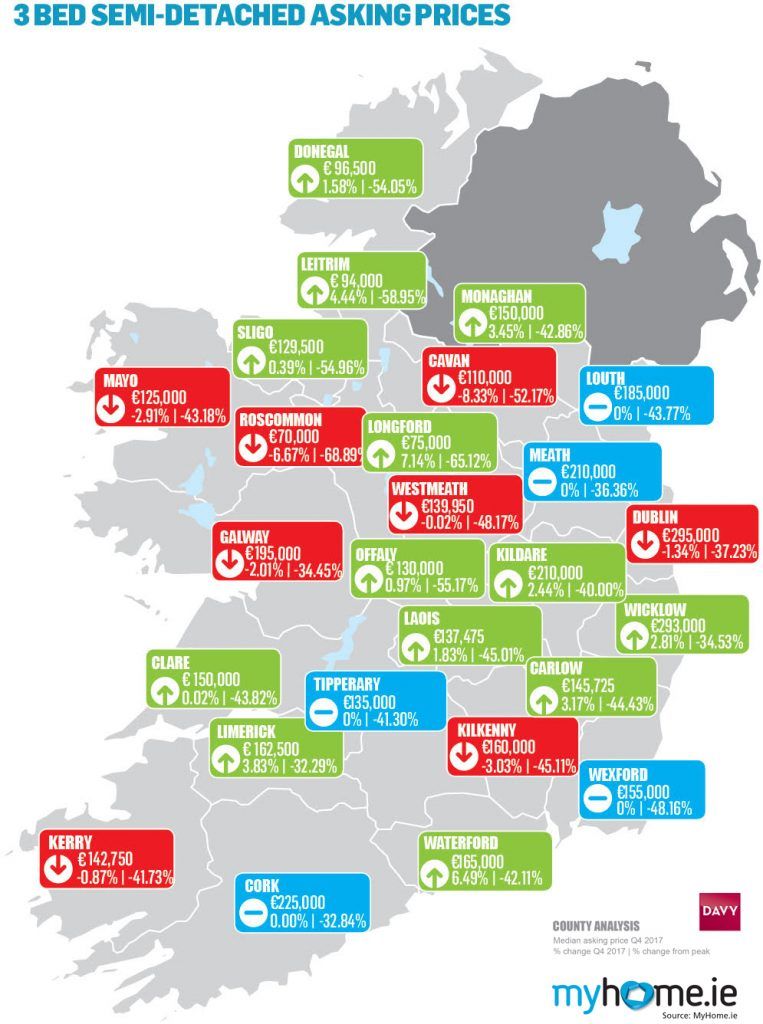

The author of the report, Conall MacCoille, Chief Economist at Davy, said the tighter Central Bank rules will serve to slow house price inflation in Dublin.

"Homebuyers in Dublin have been taking out higher levels of mortgage debt, but with the availability of credit constrained, further price increases will also be curtailed slightly in 2018. However double-digit price gains are likely to continue outside the capital where the recovery began later, prices are cheaper and there is still scope for leverage on mortgage lending to rise."

"For example the median first-time-buyer in Dublin during the summer had an income of €77,000, a deposit of €52,800 and purchased a home worth €321,000. This meant in Dublin the median house price-to-income ratio for first time buyers was 4.2x. However, prices are less stretched in other areas of the country. The median first-time-buyer in Leinster had an income of €56,000, deposit of €22,000 but purchased a house worth €179,000 – implying a house price-to-income ratio of just 3.2x".

"One of the benefits of rising house prices is a reduction in the number of people in negative equity. Many Irish households have been unwilling to move home due to their stretched finances, specifically their lack of housing equity.

According to Angela Keegan, Managing Director of MyHome.ie, the price increases of 2017 were largely driven by strong jobs growth, rising incomes and increasing competition among buyers for the limited number of homes available.

She believes that the Help to Buy scheme and the easing of mortgage lending rules by the Central Bank of Ireland led to an undoubted increase in first time-buyer activity, as well as an increase in prices. As a result of those policy interventions, prices hit double digit growth.

The author of the report, Conall MacCoille, Chief Economist at Davy, said the tighter Central Bank rules will serve to slow house price inflation in Dublin.

"Homebuyers in Dublin have been taking out higher levels of mortgage debt, but with the availability of credit constrained, further price increases will also be curtailed slightly in 2018. However double-digit price gains are likely to continue outside the capital where the recovery began later, prices are cheaper and there is still scope for leverage on mortgage lending to rise."

"For example the median first-time-buyer in Dublin during the summer had an income of €77,000, a deposit of €52,800 and purchased a home worth €321,000. This meant in Dublin the median house price-to-income ratio for first time buyers was 4.2x. However, prices are less stretched in other areas of the country. The median first-time-buyer in Leinster had an income of €56,000, deposit of €22,000 but purchased a house worth €179,000 – implying a house price-to-income ratio of just 3.2x".

"One of the benefits of rising house prices is a reduction in the number of people in negative equity. Many Irish households have been unwilling to move home due to their stretched finances, specifically their lack of housing equity.Explore more on these topics: