“Essentially, it would mean that people would wind up with significantly more money in their pockets.”

Tax refund specialists

Taxback.com are calling on the government to consider introducing a flat rate expense for thousands of employees working from home in Ireland.

Since the onset of the Covid-19 pandemic, thousands of employees in Ireland have been working remotely and employees with the capacity to work from home have been encouraged by the government to remain doing so for the foreseeable future as restrictions are gradually eased.

Tax relief

is currently available to employees working from home in Ireland to cover expenses such as electricity, heating and broadband, although recent research suggests six in 10 Irish employees

are unaware of how to go about claiming it.

Taxback.com, however, have described the current relief arrangements as “meagre” and are calling on the government to instead introduce a flat rate expense to incentivise and encourage employees to make their remote working situation more permanent.

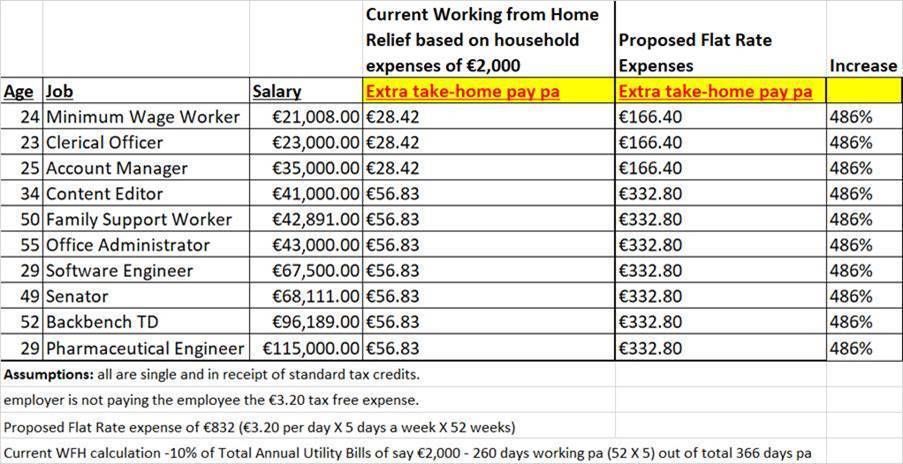

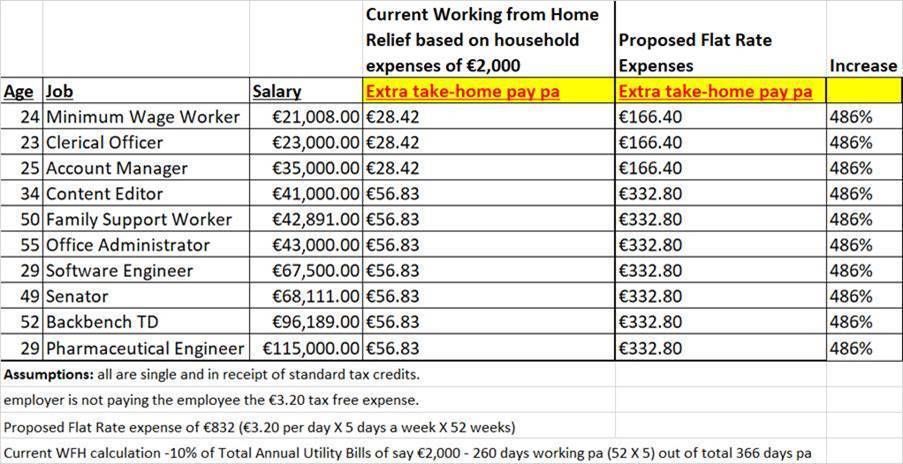

Such a flat rate expense, Taxback.com claim, could save the average worker up to €300 per year.

“As it stands, if a person works from home, they can apply for some tax relief on the cost of utilities and other expenditures that might be incurred over their working year,” Joanna Murphy, CEO of Taxback.com, said.

“The process is a little arduous, with workers having to supply a letter from their employer and collect all relevant utility and other bills. The amounts received at the end, although welcome, are not very much – perhaps on average between €20 - €60 depending on the worker’s salary and other factors.

“We are advocating simply that a new category of flat rate expenses be included for these workers – this type of relief is already embedded in our tax system, so its rollout could be relatively straight forward.

“Essentially, it would mean that people would wind up with significantly more money in their pockets – our estimates suggest the difference could be anywhere from €160 - €300 or more.”

Taxback.com ran calculations on 10 different professions in an attempt to show how the new flat rate expense (FRE) allowance could work in practice and how vastly different the value would be to the average worker when compared with the relief already in operation (see table below).

Commenting on the potentially unexpected costs remote workers will accrue, Murphy added: “The obvious ones are heating, electricity and perhaps broadband expenses. Currently, from a tax perspective, an employer can pay €3.20 a day to their employee to cover these additional costs. This payment is tax free, which means they won’t be deducting PAYE, PRSI or USC from that amount.

“But it isn’t a legal obligation to do this, however, and in these straightened times, when many businesses are cutting budgets just to stay afloat, many employers will not be in a position to do so.

“Introducing an FRE equivalent to this €3.20/day payment would really give a welcome capital injection to an employee’s finances and would take the pressure off employers who now find themselves with a whole new remote workforce, to pay the cost of utilities etc.”

Taxback.com say that such an expense, if introduced, should be available to all employees who work from home on a part-time or full-time basis.

More information on eworking, home workers and expenses available to them can be found on the Revenue website

here.

Commenting on the potentially unexpected costs remote workers will accrue, Murphy added: “The obvious ones are heating, electricity and perhaps broadband expenses. Currently, from a tax perspective, an employer can pay €3.20 a day to their employee to cover these additional costs. This payment is tax free, which means they won’t be deducting PAYE, PRSI or USC from that amount.

“But it isn’t a legal obligation to do this, however, and in these straightened times, when many businesses are cutting budgets just to stay afloat, many employers will not be in a position to do so.

“Introducing an FRE equivalent to this €3.20/day payment would really give a welcome capital injection to an employee’s finances and would take the pressure off employers who now find themselves with a whole new remote workforce, to pay the cost of utilities etc.”

Taxback.com say that such an expense, if introduced, should be available to all employees who work from home on a part-time or full-time basis.

More information on eworking, home workers and expenses available to them can be found on the Revenue website here.

Commenting on the potentially unexpected costs remote workers will accrue, Murphy added: “The obvious ones are heating, electricity and perhaps broadband expenses. Currently, from a tax perspective, an employer can pay €3.20 a day to their employee to cover these additional costs. This payment is tax free, which means they won’t be deducting PAYE, PRSI or USC from that amount.

“But it isn’t a legal obligation to do this, however, and in these straightened times, when many businesses are cutting budgets just to stay afloat, many employers will not be in a position to do so.

“Introducing an FRE equivalent to this €3.20/day payment would really give a welcome capital injection to an employee’s finances and would take the pressure off employers who now find themselves with a whole new remote workforce, to pay the cost of utilities etc.”

Taxback.com say that such an expense, if introduced, should be available to all employees who work from home on a part-time or full-time basis.

More information on eworking, home workers and expenses available to them can be found on the Revenue website here.