Over one million workers in Ireland are set to be affected, with ‘the squeezed middle’ likely to suffer “a major financial blow”.

Full-time workers who have been in receipt of Covid-19 benefits from the government face tax bills ranging from €150 to just under €3,000 come the end of 2020.

That’s according to Taxback.com, who claim that employees who have received the Covid-19 Temporary Wage Subsidy Scheme (TWSS) or the Pandemic Unemployment Payment (PUP) will be hit with a tax bill at Christmas time that many are currently unaware of.

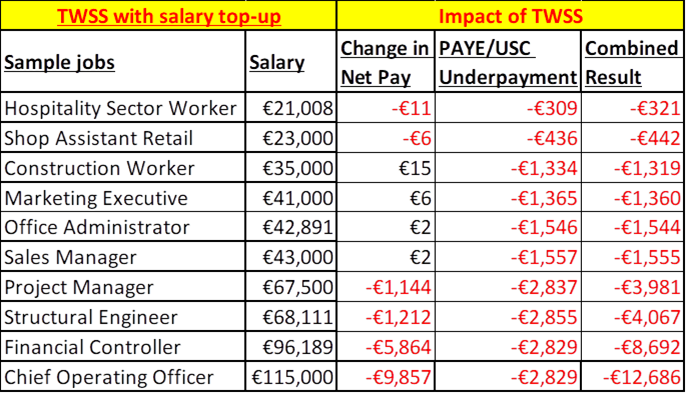

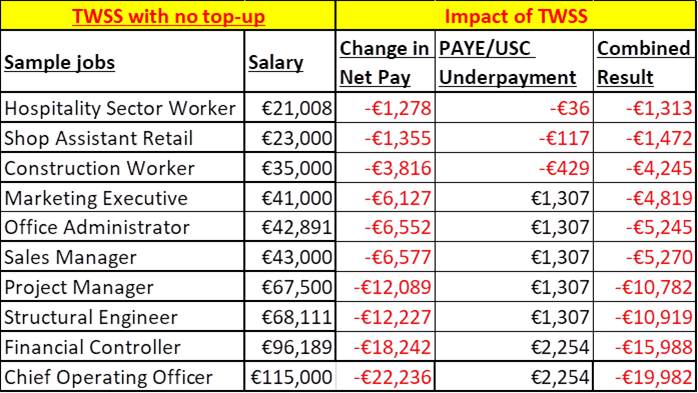

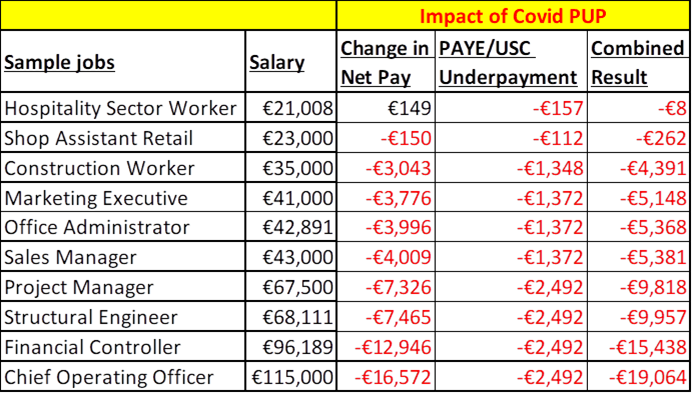

On Friday, Taxback.com released their analysis of the impact of the TWSS and PUP on salaries in 10 different sample scenarios (see below), which outline the change in net pay, the impending 2020 tax bill (PAYE/USC underpayment) and combined result for employees depending on their income.

TWSS

Employees earning above €20,000 with no income top-up will see their net incomes drop during the 23weeks by €1,000 up to €22,000 or more.

Employees with an income top-up from their employers won’t suffer a net income drop in 2020 unless their income is over €44,000, but will face a tax bill of between €300 and €2,829 at year end depending on their income.

PUP

Workers that had been on incomes over €20,000 will generally suffer significant net income drops in 2020 and will also face tax bill of up to €2,494 at year end.

Since the introduction of the pandemic payments in March, just under 552,000 workers have been paid via the Temporary Wage Subsidy Scheme (TWSS) and 517,600 have received the Pandemic Unemployment Payment (PUP) at some stage.

A recent survey by Taxback.com with 2,500 respondents claims that 57% of people are not aware of a future tax liability coming down the tracks and that it is likely to come as “a major shock” to thousands of people at the end of the year.

Depending on how that tax burden is spread, says Marian Ryan, Consumer Tax Manager with Taxback.com, it could mean less money in the pockets of employees in 2021 and possibly even 2022. Ryan added that feedback from both employer and employee clients suggests there is a possibility that they will not know what they will, or can, do about it.

Furthermore, Ryan said that Taxback.com have received calls from employers in recent weeks concerned that they are unsure of how to address employee queries such is the ambiguous nature of the information on the topic.

At present, it has not yet been decided how any tax liabilities will be recouped from affected employees, but depending on the income of an individual, it is likely that it would be spread over a period of time, rather than in one lump sum.

“When assessing the impact, we were mindful of the immediacy with which the Government had to roll out the scheme, so anomalies were to be expected,” Marian Ryan said.

“The issue, however, is that thousands of employees appear to be completely unaware of what is coming down the tracks.”

Commenting on who is likely to be impacted most by a tax bill coming down the tracks, she added: “Those on low incomes that are below the income tax threshold should be largely unimpacted on either scheme.

“Also, those whose employer didn’t top-up the TWSS payment will have suffered from lower income during the pandemic, but should have a lower tax liability at the end of the year or may be due a rebate if their income is greater than about €38,000. However, any tax rebate will pale in size compared to the loss of income during 2020.

“Interestingly, there’s another idiosyncrasy when it comes to the salaries of a certain cohort of workers – because of the cap on payments, a worker on a salary €35,000 will have a larger underpayment of tax at the end of the year, than someone who earns €38,000.

“This is because the employer of a worker on €35,000 will get a TWSS of €390.62, whereas the employer of a €38,000 salaried worker is only entitled to a payment of €350.

“Of course, certain cohorts or workers will be affected more than others. It would appear that what has been previously termed as ‘the squeezed middle’ with incomes between €35,000 and €70,000 are likely to suffer a major financial blow.”

LISTEN: You Must Be Jokin’ with Aideen McQueen – Faith healers, Coolock craic and Gigging as Gaeilge