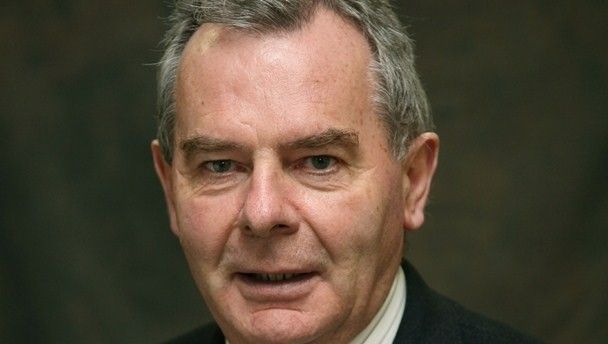

How did one of the world’s richest men go from minted to skinted broke in just three years? Let JOE break it down for you.

By Sean Nolan

So he was richer than P Diddy and Jay-Z combined. Where did he get his money in the first place?

Well, Sean Quinn’s story is a proper rags-to-riches tale. More gravel-to-riches in his case – he began life in 1973 quarrying the stuff out of his family farm and selling it to local builders. From this he created Quinn Cement before his Quinn Group expanded into everything from building supplies to hotels, insurance to plastics.

By the end of 2008, he employed over 5,500 people and was estimated to be worth somewhere between €3.75-4.75 billion. That’s a €1 billion margin of error, but sure what’s a billion to a guy like that anyway?

So what happened, was it the drink, the drugs or the ladies that took him down?

Sadly, nothing nearly as fun as any of those. It was a bank that took him down, the same bank that almost sank the nation. Quinn began buying contracts for difference (CFDs) in Anglo shares. These financial instruments are a gamble on the share price going up, if it does, you pocket the increase. If it goes the other way, you are stung for the hit.

So Quinn got hit with that, that’s what did for him?

Well, partly. Then to cover the huge losses Anglo gave him enormous loans every month so he could pay off his creditors. In six days around St Patrick’s Day 2008, when bank stock worldwide rocked because of the fears over the US bank Bear Stearns, Quinn borrowed €367.5 million from Anglo. This was used to pay the losses as the share price dropped and Quinn was stung for the loss. In total, Quinn would borrow €2.34 billion from Anglo just to pay off the losses and to buy actual shares in the bank.

Holy cow. How could someone who was a sensible businessman for so long get caught up in this mess?

He must have believed the hype. That bank share prices, based on the credit bubble, would keep rising. If they did he would be even richer than he was. It was a gamble. He lost big time.

And that’s that?

In a nutshell. Add in Quinn’s other borrowings to Anglo and total is close to €2.9billion but it was the shares that broke him and cost him his businesses.

Wait a minute. Aren’t Anglo a bit to blame to keep shovelling out the money?

Yes. They were trying to keep the share price from completely tanking if all the Quinn shares were sold at once. And compared to some, they saw Quinn as lower risk. He was the richest man in the country at the time, remember? But they did go way too far in their financial support.

Why didn’t Anglo just take over his businesses, they were making money, right?

They did – Quinn had to sign them over to get the loans – and they were/are making money. Not enough, though, to pay off the monstrous debt he owes. So after a few months of legal wrangling, in various courts in various countries, Quinn took the step to declare bankruptcy in Belfast today.

Is that the end of then, tough luck Anglo (or the taxpayer)?

Seems not. Quinn lives in Cavan and Anglo (or Irish Bank Resolution Corporation, or IBRC, as they are now called) are saying they will get the legality of his bankruptcy in Northern Ireland checked out and they plan to continue to actively pursue him for the money.

Does he have any money left anywhere (nudge, nudge, wink, wink)?

Good question. Some bits of the Quinn Group overseas have allegedly been put into the names of other family members but we couldn’t speculate on his remaining wealth any further than that.

So what now?

Well, this the thing – the future may not be so bleak for him. By going down the route of declaring bankruptcy in Belfast, where the case went through the UK courts, Quinn could be back up and running within a year, rather than the 12 years he would be struck off on this side of the border for bankruptcy. However, IBRC are not going to give this up. Nor should they, I’d suggest, as it’s us he owes the money to now thanks to the bank guarantee scheme.

No happy ending then.

No. For Quinn or us it seems. Everybody lost in this gamble.