Well… shit.

The good news is, we’re in the upper part of the world rankings in something. The bad news is, it’s the list of the worst tax havens in the world.

Ireland has been branded one of the world’s worst tax havens in hard-hitting report by development agency Oxfam.

The criteria for the list was based on the “most damaging tax policies,” such as zero corporate tax rates, which ultimately harm the average taxpayers, the NGO said.

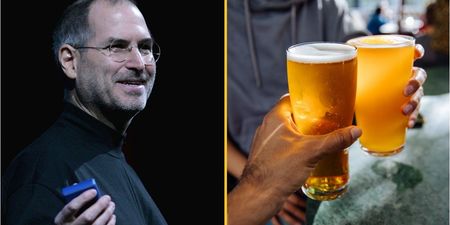

In a list of 15 countries, Ireland placed in sixth spot on the list for facilitating corporate tax avoidance through forms of aggressive tax planning, the shifting of profits and establishing sweetheart deals with companies similar to the high profile Apple tax ruling of late.

In short, according to the report, we allow large companies to operate within our shores without them paying any substantial or meaningful tax to the government.

Oxfam Ireland CEO Jim Clarken said: “Ireland is part of a toxic global tax system servicing the very wealthiest while ordinary people pay the price and lose out on essential public services.

“We are known as a country of good fun, bad weather and awful tax policies. This is no badge of honour.”

Bermuda tops the list of 15 countries followed by the Cayman Islands and the Netherlands with Switzerland and Singapore taking the fourth and fifth spots on the list.

Luxembourg places one spot behind Ireland on the list in seventh spot on the list in what Oxfam refers to as the “global race to the bottom on corporate tax.”

The full rankings are as follows: 1) Bermuda; (2) the Cayman Islands; (3) the Netherlands; (4) Switzerland; (5) Singapore; (6) Ireland; (7) Luxembourg; (8) Curaçao; (9) Hong Kong; (10) Cyprus; (11) Bahamas; (12) Jersey; (13) Barbados; (14) Mauritius; and (15) the British Virgin Islands.

LISTEN: You Must Be Jokin’ with Aideen McQueen – Faith healers, Coolock craic and Gigging as Gaeilge