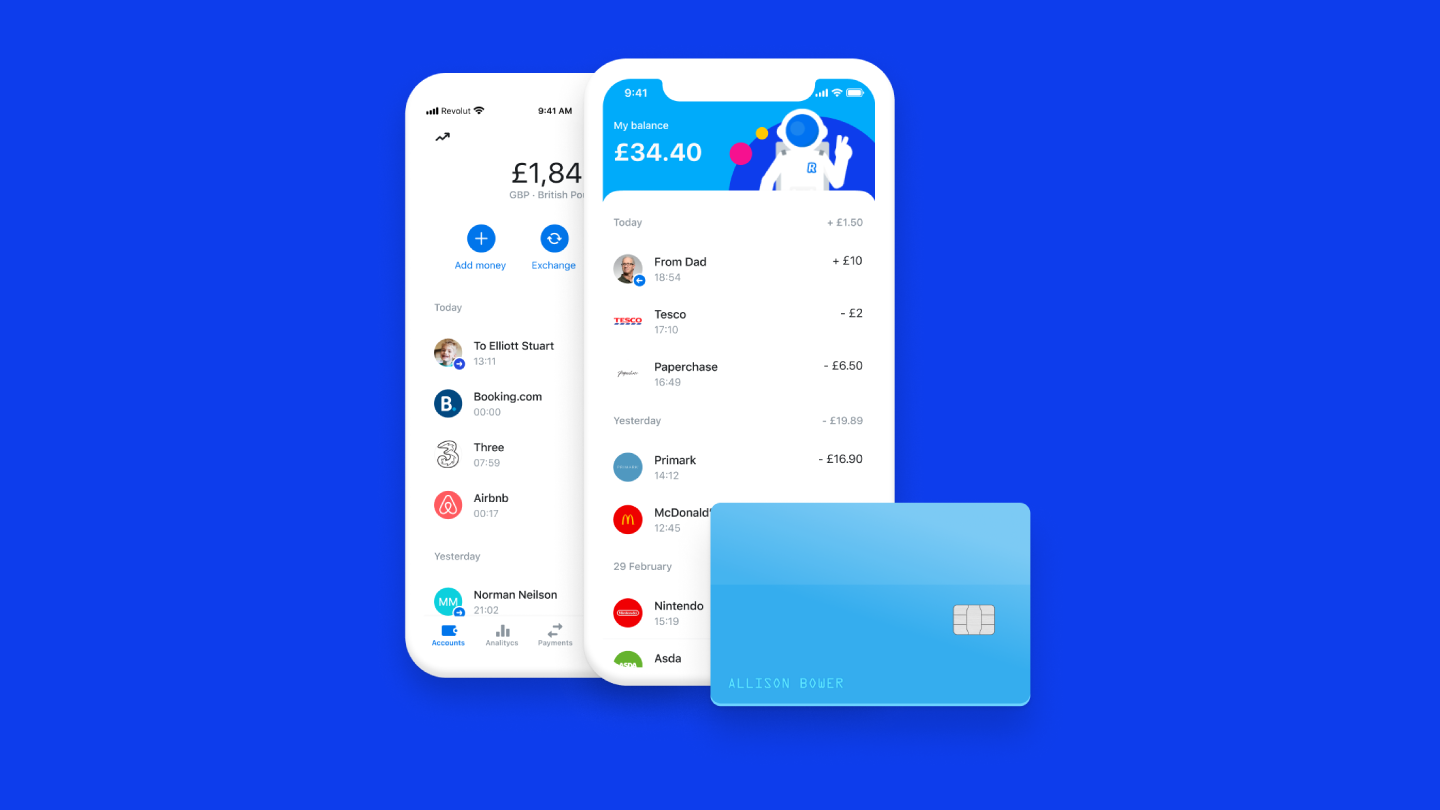

Brought to you by Revolut

A safe and easy way for parents to teach their children essential financial skills.

Global financial platform Revolut has launched Revolut Junior to cater especially for kids as young as seven right up to 17-year-old teenagers.

Revolut Junior will enable kids and teenagers in that age bracket to manage their money and build essential financial habits that will last them for life.

To do that, they’ll be equipped with their own Revolut Junior app and their own Revolut card, but it will all be under the control of a parent or guardian who sets up the account in the first place.

Here’s how it works:

A parent or a guardian with an existing Revolut account can set up and fund a Revolut Junior account from their own Revolut account and will remain in complete control of the junior account holder’s security features. The holder of the junior account cannot make or receive transfers on the Junior app.

To that end, the holder of the Revolut Junior account can only spend whatever funds have been allotted to it by a parent or guardian, who will be notified instantly whenever the junior account is used.

Furthermore, the parent or guardian will be able to see where funds from the Revolut Junior account have been spent and a default setting in the app prevents Junior cards from being used at certain age-restricted merchants (merchants who only sell alcohol, cigarettes or gambling products, for example).

While the parent or guardian retains control over the account, the Junior account holder will be issued with a card linked to the account they can use to spend or withdraw money. The Junior app allows them to view all recorded transactions so they can save, plan budgets and help develop their financial management skills.

The protection of the privacy of children in the development of Revolut Junior was paramount, according to Revolut Junior Product Owner, Aurelien Guichard.

“Children using Junior are data subjects, and any child has the same rights to privacy as an adult,” he said.

“We spent a lot of time educating child users about their rights. We explained what data of theirs we have, what we do with it, and what their rights are.”

Revolut Junior is also one of the first products to implement guidelines outlined in an age-appropriate design code published by the UK Information Commissioner’s Office at the start of this year to protect children’s privacy online.

“Given how recent their release was, I’m proud to say that we’re ahead of the game and one of the first products to implement them,” Guichard added.

An in-depth guide on all the information you need to know about Revolut Junior is available right here.

One app to manage your entire financial life, Revolut offers a better way to handle your money and is used by over 10 million people worldwide. Get started right here.

Brought to you by Revolut